Low Code and AI to develop applications in the banking industry

Overcome the barriers that hinder innovation in your financial company. Create robust solutions with a Low Code development platform powered by Artificial Intelligence.

Fraud prevention, credit risk management, and money laundering are dynamic processes that require real-time response. DIANA enables assisted modeling of rules and flows, allowing you to quickly implement and test new business logic for risk assessment or fraud detection. Low Code ensures that these new rules are deployed and connected to your analytical systems with the speed needed to protect the institution.

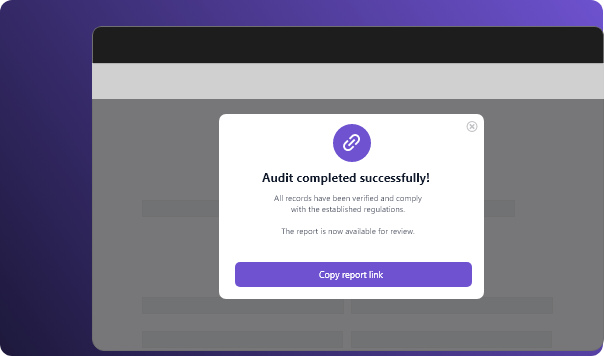

Comply with regulations and accelerate auditing

Regulatory burden and transparency requirements are constant. Ensuring compliance (GDPR, PCI DSS, etc.) should not be an obstacle. DIANA allows you to build applications with assisted modeling that follows best practices and ensures full traceability of changes and operations. Thanks to simple maintenance with Low Code and the AI proposal and confirmation flow, you transform process auditing and governance into an agile and secure procedure, maintaining the strict control required by banking.

Overcome the IT talent shortage

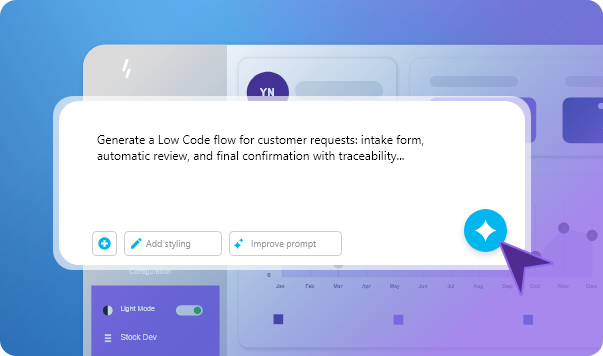

The shortage of specialized programmers (Java, front-end, back-end) and the fierce competition for AI/Cloud experts slow down product creation through traditional methods. The democratization of development with DIANA allows your business team (Citizen Developers) to create robust solutions through conversational prompts. On one hand, it frees senior programmers to participate in high-value strategic projects. On the other, it empowers business analysts to collaborate directly in the application, using their knowledge of the banking core within the Low Code with AI platform. In this way, your financial company can modernize and compete at the pace of FinTechs.

Proven results

in weeks, not years