Application Development with Low Code: Customizable and Extensible Platform

September 19, 2025Credit Origination with Low Code + AI: Robustness and Agility

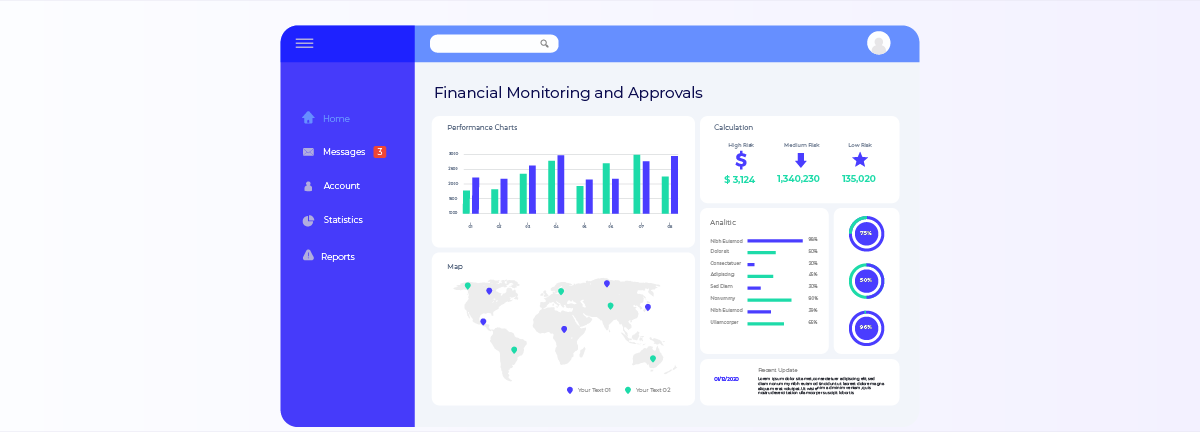

Low Code platforms and Artificial Intelligence have emerged as the perfect combination for efficiently building business applications. Credit origination using this approach represents a clear example of digital transformation, where development agility merges with the robustness of financial operations, modernizing processes that have traditionally been slow and error-prone.

But how can a platform that brings together the best of Low Code and Artificial Intelligence completely transform such a critical and complex process? We invite you to read the full article.

Low Code + AI: what it looks like in practice

Imagine a platform where, in addition to dragging and dropping components, you can also create what you need simply by writing natural language prompts. With Deyel, a Low Code platform that integrates artificial intelligence agents, you can model applications through conversational prompts. That means generating pages, defining entities, and building advanced rules just by giving instructions and receiving suggestions. You also have an expert agent that teaches you how to use the platform.

Combining Low Code and AI allows teams to digitize and automate the creation of business applications in minutes, through an intuitive conversational process that replaces repetitive manual tasks.

A Methodological Approach Powered by AI

A Low Code platform that integrates Artificial Intelligence allows users to build applications through a structured approach that ensures best modeling practices from the very beginning.

Conversational Development with Prompts

Users interact with the platform in natural language to build their applications. Through conversation, the main objects are generated: definition of personas and User Stories, application modeling on the canvas, navigation flows per persona, and modeling of entities, pages, and advanced rules.

Embedded Modeling Best Practices

The platform guides users so that applications grow in an orderly and consistent manner. The AI incorporates a methodological approach, suggesting clear persona descriptions, business-aligned user stories, and structured flows, while also proposing next steps to complete the modeling of all application objects.

Proposal and Confirmation Flow

For each request, the AI proposes a solution, such as creating a new action on the canvas, a page, an entity, or a rule. The user retains full control, validating each proposal before the action is executed on the platform, ensuring control, quality, and transparency.

Smart Templates to Accelerate Development

Depending on the case, the platform can generate objects from scratch or use predefined templates that already include common functions and best practices. There are B2B and B2C templates, as well as vertical business templates, such as the Credit Origination for Banks template.

Simple Maintenance with Low Code Tools

Although the starting point is conversational, maintenance and evolution are carried out with the platform’s visual tools. This ensures governance and traceability of changes, making applications sustainable and easy to manage in the long term, even for citizen developers.

Smart Context and Consistent Generation

The platform’s AI understands the current state of the application and the user's role, responding in a personalized and accurate way. When generating new objects, it takes into account what has already been defined, reuses field naming standards, respects data types, and suggests relationships and advanced rules consistent with the existing model.

How does this benefit credit origination?

A digitized credit origination process can greatly benefit from these capabilities:

- Agile and fast development: Instead of taking weeks or months to create a new credit application interface, a business analyst or developer can interact with the platform’s artificial intelligence to generate workflows, pages, and business rules in minutes.

- Quality and consistency: The AI incorporates best modeling practices, ensuring that generated applications follow standards, reuse consistent field names, and respect existing data types. This is vital in a sensitive process like finance, where precision is crucial.

- Flexibility and smart templates: The platform can generate solutions from scratch or based on predefined templates. For example, a “Credit Origination for Banks” template can serve as a starting point, further accelerating the process by including common functions and best practices from the banking industry.

- Simplified maintenance: Once the application is in production, its maintenance is done using No Code/Low Code visual tools, making governance and change tracking easier. This ensures the application remains sustainable and easy to manage over time.

- Integration with the banking CORE: One of the biggest challenges in the financial sector is the rigidity of legacy systems. The platform facilitates integration with the banking CORE and other existing systems, allowing modernization of front-end and middle-office processes without having to replace the core infrastructure.

The perfect synergy: robustness of Low Code and agility of AI

The adoption of a Low Code platform powered by AI allows business leaders and technology specialists to collaborate more effectively. Teams can focus on business logic and customer experience, while the technology takes care of repetitive development tasks. In conclusion, the combination of Low Code and Artificial Intelligence is not just a trend; it is the best solution for banks and the banking industry to accelerate their credit origination processes and stay ahead. With this synergy, companies can achieve digitalization and automation with the robustness required for mission-critical applications and the agility to innovate quickly, transforming their operations and gaining a competitive edge in the market.